Money Matters

UK VAT rates and VAT FAQs

Get a clear breakdown of the UK VAT rates and thresholds, and answers to key questions such as who pays VAT and how to pay VAT.

For your business, you are probably charged VAT on most of the goods and services you buy.

That means charging your customers VAT, keeping VAT records and paying the VAT you’ve collected to HMRC.

Read this article to learn more about VAT.

Here’s what we cover:

- What is VAT?

- What is the UK VAT Rate?

- Who pays VAT?

- What is the UK VAT registration threshold?

- How to pay your VAT bill

- How to charge VAT

- Understanding VAT terms and phrases

- Final thoughts: Getting to grips with VAT

What is VAT?

Value Added Tax, or VAT, is a tax applied to goods and services.

Sometimes VAT is called a consumption tax, because it’s applied to end consumer purchases.

It’s applied by the individual or business selling the goods or services as a percentage on top of the sale price. In other words, if something is sold for £1, then the price charged to the consumer will be £1.20 (if the 20% standard VAT rate is applied).

VAT is important because it’s one of the biggest single forms of government revenue, representing 6% of national income. Worldwide, it accounts for 20% of tax revenue for governments.

It’s important for businesses because registering for VAT often lets them reduce the amount of VAT they pay on their own purchases.

In the UK, VAT is applied by businesses or individuals on behalf of the government. The business or individual must report the amount of VAT they’ve both collected and also paid via periodic VAT returns.

Typically, these are submitted every three months (quarterly), but some businesses submit them monthly or annually.

Following submission of the VAT Return, the business or individual must pay the balance of the VAT to the government. That is to say, they pay the VAT they’ve collected minus the VAT they’ve been charged by others.

Only businesses or individuals that have registered for the VAT system can charge VAT. Registration is mandatory once the turnover of the business reaches £85,000.

But it’s also possible to voluntarily register for VAT if your turnover is lower than this.

What is the UK VAT Rate?

There are three rates of VAT that are applied depending on what’s being sold.

Sometimes, the situation in which the goods or services are being sold can affect which rate is applied, too.

For example, some disability products can be zero-rated for VAT – but only if they’re sold to people who are disabled.

This is what the current VAT rates are:

It’s important to understand that zero rated isn’t another way of saying something is exempt from VAT, or VAT-free.

You still have to make a note of zero-rated sales or purchases in your VAT accounting, and issue correct VAT invoices if they’re required.

Let’s take a look at how much is VAT in the UK.

John Smith runs an eBay shop selling computer parts he imports from China. One of them costs him £90, and he adds a 30% profit margin.

That brings the retail price up to £117.

When he sells this, he adds 20% VAT, bringing the price up to £140.40.

He works this out by simply multiplying his sale price by 1.2 (and if he wanted to work out a price for something he’s buying minus its VAT component, he could simply divide the price by 1.2 instead – assuming the 20% standard rate applies).

If John sells to another VAT registered business then he still charges VAT in the same way.

However, this is considered input VAT by the purchasing business, and they can use it to offset the VAT they’ve collected on their sales.

John must provide them with a correctly formatted VAT invoice, showing the rate and amount of VAT applied, among other things.

How VAT has changed

VAT was introduced into the UK in 1973 but had been used in Germany and France from the 1950s onwards, where it was sometimes referred to as a goods and services tax (GST).

This is how countries such as Australia, New Zealand and Canada continue to refer to their own VAT-like tax.

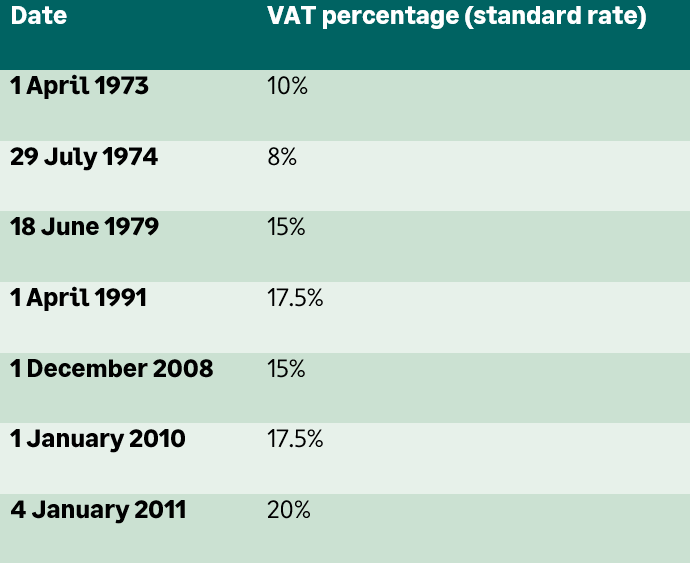

Upon introduction in the UK in 1973, the standard rate was 10%. Since then it’s risen and occasionally fallen.

Today’s rate of 20% is the highest that’s ever been applied and has been maintained for a decade, despite continuing political pressure to reduce it.

At one point in UK tax history there was even a higher rate of VAT, charged at 25% (although reduced to 12.5% a little later).

This applied to petrol and items considered luxuries such as fur coats, hi-fi equipment, televisions, and jewellery. However, this rate was abolished in 1979.

Here’s the historic standard VAT rates, starting with the introduction of VAT in 1973:

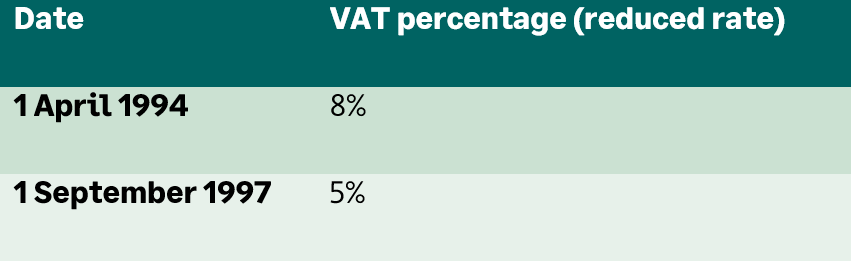

And here’s the historic VAT rates for the reduced rate, which is much more straightforward:

Who pays VAT?

VAT is paid by consumers on purchases they make from VAT-registered businesses. As such, it’s an end-user tax applied at the point of consumption.

When it comes to handing VAT to the government, that’s the responsibility of VAT-registered individuals and businesses.

They pay the VAT to the government after filing their monthly, quarterly or annual VAT Returns.

Until the deadline for payment, which is usually one month and seven days after the end of the VAT period, the business gets to hold on to the VAT money.

And there’s nothing wrong with putting it into a high interest account, or even using it to help with cash flow (e.g. effectively giving a short term loan to yourself).

You just have to make sure the money will be available when it’s needed to pay the VAT bill.

VAT is one of a small number of tax systems that turn businesses into unpaid tax collectors for the government.

However, the benefits of being able to claim back tax spent on purchases makes this worthwhile.

What is the UK VAT registration threshold?

Businesses with a VAT taxable turnover above a certain amount must, by law, register for VAT.

The exception to this is if the business only sells goods or services that are exempt from VAT.

The current VAT threshold is £85,000. If your turnover for which VAT applies goes over this, you are required to register for VAT.

The government says there are fundamentally two ways to measure if you’ve passed the threshold, or will do so soon.

Either can be true to require you to register for VAT:

- You anticipate going over £85,000 in VAT taxable turnover in the next 30 days.

- Your VAT taxable turnover was more than £85,000 over the past 12 months (a rolling 12 month period from today’s date, rather than a calendar year).

It can be difficult working out when you should register for VAT. Speaking to your accountant can help because they can help forecast your income for the coming period.

But what’s known as the VAT trap arises when a business finds itself crossing the VAT threshold, yet without having charged VAT to customers and without the required VAT accounting.

How to pay your VAT bill

When it comes to handing over the VAT payment to HMRC, you have several options.

Most businesses use direct debit.

This simplifies things significantly and means you needn’t think about it, other than ensuring the funds are available in the correct account at the right time.

However, if you want to keep more control over payments then other options are available, as follows.

But you must remember that some payment methods take up to three working days to be processed (including direct debits), and there might be surcharges too.

Making Tax Digital for VAT simplifies the whole procedure around collecting and reporting VAT by requiring the use of software. This makes it a cinch to know when payments are due. You can learn more about MTD by visiting our MTD hub.

Same day payments

- Online (Faster Payments, CHAPS or via bank transfer using online banking)

- Telephone (Faster Payments)

Up to three working days

- Online (BACS or via debit or corporate credit card)

- Direct debit

- Standing order (only for Annual Accounting Scheme, or payments on account)

- In person at your bank or building society

You may need to speak to your bank or building society ahead of time to see if they’re signed up to the Faster Payments system.

How to charge VAT

Charging VAT is pretty simple. You just add the relevant VAT percentage to your sale price, which the customer then pays.

For example, you charge the customer £12 for a widget that costs £10 and has VAT applied at the standard rate of 20% (i.e. £10 + 20% = £1.20).

There’s no legal requirement to list prices including VAT but not doing so might incur the wrath of the Advertising Standards Authority.

Because not including VAT in listed prices is so common, they include the requirement in their Committee of Advertising Practice guidelines.

However, if you mostly sell to other businesses, you might list prices without VAT provided this is clearly indicated.

If your customer is also VAT registered then you must provide a VAT invoice. This differs from standard or basic invoices because, by law, it needs to contain additional information.

For those using the basic VAT system, it should include the following:

- A unique invoice number.

- The time of the supply (that is, the goods or service you sell).

- The date of issue of the document (required only if this is different to the time of supply).

- Your name, address and VAT registration number.

- The name and address of the person to whom the goods or services are being supplied.

- A description sufficient to identify the goods or services supplied. Each description should list the quantity of the goods or the extent of the services, and the rate of VAT and the amount payable, excluding VAT.

- The total amount payable, excluding VAT.

- The rate of any cash discount offered.

- The total amount of VAT chargeable, expressed in sterling.

- The unit price.

- The reason for any zero rate or exemption.

Understanding VAT terms and phrases

VAT has its own terminology, which can be very confusing. So here’s some simple definitions to help you get to grips with charging, reporting, invoicing and paying VAT.

Input VAT

The VAT you pay on purchases that you can subsequently claim.

Output VAT

The VAT you charge on sales.

VAT Return

The periodic tax returns you must submit to HMRC as part of your VAT obligations. Nowadays this must be done digitally, via software, as part of the Making Tax Digital for VAT rules. The VAT Return contains nine boxes that you fill in, as applicable.

VAT period

The period for which you calculate and then report VAT via a VAT Return. Typically this is quarterly (every three months), but it can be monthly or annually depending on the needs of your business.

If you’re unsure how to calculate VAT, visit the HMRC for expanded information.

Or if you have a simple calculation to do, you can make use of a VAT calculator.

Supplies

The goods and services you sell. For example, if you sell a widget to a consumer, then you have made a supply.

Inputs

The goods or services you buy to which VAT is applied by the seller.

Flat rate scheme

An alternative to calculating VAT where you instead apply a flat rate percentage to your total turnover. This makes things simplifier but could mean you end up handing over more VAT than you would otherwise.

Tax point

The date when the supply of goods or services is deemed to have taken place for the purposes of VAT accounting.

VAT invoice

An invoice that lists items such as the rate and amount of VAT, plus your VAT registration number. Supplying one each time isn’t a legal requirement but customers can request one, and any individual or business that’s VAT-registered should do so.

Threshold

The turnover amount for you or your business beyond which you’re legally required to register for VAT. Currently this is £85,000 and it applies only to the VATable goods or services you sell (this should be applied to total VATable turnover and not just profits). The threshold typically increases yearly.

Retail schemes

Several alternatives to calculating VAT that simplifies VAT accounting for retailers. Included is the point of sale scheme, which lets you more easily calculate VAT from your daily gross takings (DGT). It also includes two direct apportionment schemes, and two direct calculation schemes.

VAT registration number

The individual number that applies to your business and identifies it for VAT accounting purposes.

Distance selling

Before Brexit, sales to countries in the European Union (EU) were referred to as distance sales. Following Brexit, only sales from Northern Ireland to the EU are considered distance sales for UK businesses. Sales to EU countries from Great Britain and considered exports.

One Stop Shop

A scheme by which you can account for VAT in a single return when selling to consumers within EU countries.

Final thoughts: Getting to grips with VAT

VAT can be confusing but getting to grips with it takes only a little effort, and once you’ve learned what you need to know you can get on with your business just like thousands of others in the UK.

Don’t forget that seeking expert help is always a good idea.

Accountants and other tax experts work with VAT day in, day out. Speak to them if you’re struggling with any of the details, or how to implement VAT within your business.

Editor’s note: This article was first published in August 2017 and has been updated for relevance.

Ask the author a question or share your advice